David Brin: The truth about taxes (the Tea Party is wrong)

By Jeremy Bloom

By David Brin

By David BrinTo listen to Republicans, you would think we have the most oppressive tax rates ever, with the federal government hogging ever larger portions of the national economy.

Ever hear of Orwellian anti-truth? That is where you repeat the exact opposite of the truth and people start believing it.

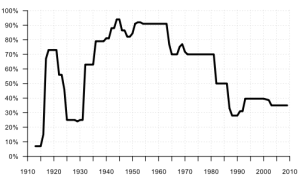

But drop by and look at the actual facts. See thiscompilation of income tax rates.. Tax rates are at historiclows. And this is for earned income. Rates for dividends and capital gains are even lower – by half - than what you see in the figure!

In the 99 years that we have had the income tax, rates for top earners were lower than they are today only twice:

1) during the 5 years before the US entry into the First World War in 1917, and

2) during the brief stretch from 1925 through 1930… when a massive asset value bubble pumped the economy into the Great Depression.

Also note this. They are LOWER for the middle class, under Obama, than they were under Bush. The “Obama tax hikes” are purely mythical.

That’s it. Today’s top rates are currently lower than at any time since 1930… and ironically that includes half of the HOOVER Administration preceding FDR. In other words, the hiking upward was first done by the same 1930 Republican Congress that brought us the Smoot-Hawley Tariffs!

Just to make this clear, so you rub it in your crazy-as-Fox uncle, income tax rates are lower than at any time in 80 years.

Just to make this clear, so you rub it in your crazy-as-Fox uncle, income tax rates are lower than at any time in 80 years.

The other big fact is the fraction of U.S. national GDP taken by the federal government. Fox’s uncles swear that this is at an all-time high. In fact, the federal share of GDP is at its lowest since 1950.

Be entrepreneurial. Make Adam Smith proud and use all this to make money. Seriously. Lure your nearest Tea Partier to make grand declarations about the oppressiveness of recent tax rates and the growing federal share of the economy and then demand a wager! Only… get it in writing.

(Originally appeared at Contrary Brin. Tea Party image Some rights reserved by AR Nature Gal)

No comments:

Post a Comment